Takeaways

- In South Georgia, recent pine sawtimber and pine chip-n-saw prices increased compared to a year ago, while pulpwood prices declined for both pine and hardwood. In North Georgia, stumpage prices for timber products declined compared to a year earlier.

- Demand-side factors that are expected to shape Georgia’s timber markets in 2026 include a weakened housing market, reduced lumber mill utilization rates, mill closures and conversions, tariffs on imports, labor shortages, and overall economic growth.

- On the supply side, factors include tighter sawtimber inventory in areas impacted by Hurricane Helene, increased timber availability and greater supplies from mill closures in adjacent areas, and ongoing logging capacity constraints.

- Overall, sawtimber prices in 2026 are expected to remain stable across most of Georgia, although some areas of South Georgia may experience modest sawtimber price increases.

2025 Georgia Timber Prices

In the third quarter of 2025, average stumpage prices for major timber products in Georgia showed mixed trends.

South Georgia

In South Georgia, pine sawtimber and pine chip-n-saw prices increased compared to a year ago, while pulpwood prices declined for both pine and hardwood. Pine sawtimber prices averaged around $28/ton, a 5% year-over-year increase, and pine chip-n-saw prices rose 16% to $23.50/ton (TimberMart-South, 2025). In contrast, mixed hardwood sawtimber averaged around $26/ton, down 17% from last year. Pine pulpwood prices fell to $9.50/ton, a 40% year-over-year decline. Hardwood pulpwood declined to $8/ton, an 8% year-over-year decrease.

North Georgia

In North Georgia, stumpage prices for all five timber products declined compared to a year earlier. Pine sawtimber prices averaged around $22/ton, an 11% decrease year-over-year. Pine chip-n-saw averaged just over $17/ton, slightly below the price a year ago. Mixed hardwood sawtimber prices averaged over $32/ton, down 8% from a year ago. Pine pulpwood prices fell 18% to slightly over $6/ton and hardwood pulpwood dropped 27% to near $6/ton.

Effects of Hurricane Helene

The modest increase in South Georgia’s pine sawtimber prices was partly attributable to Hurricane Helene. The hurricane impacted 8.9 million acres of forestland across Georgia, including some of the state’s most productive timberland, which supplies timber for sawmills concentrated in South Georgia (GFC Forest Management Group, 2024). As markets gradually absorbed salvaged timber through early 2025, sawtimber prices in later quarters of 2025 began to rise, reflecting emerging inventory shortage, particularly in areas that already had low growth-to-removal ratios prior to the storm (USDA Forest Service, 2024). However, the price increases remained modest as sawmills increased curtailments and downtime to cope with weakened lumber demand.

The sharp decline in South Georgia’s pulpwood prices was largely driven by continued salvage activities in hurricane-affected areas, combined with recent pulp and paper mill closures in the region. Mills continued to accept and process salvaged timber for pulpwood, placing additional downward pressure on pulpwood prices.

Mill Closures in Georgia

Major closures included the Georgia-Pacific containerboard mill in Cedar Springs and International Paper’s containerboard and packaging facilities in Savannah, as well as its containerboard mill in Riceboro. Collectively, these three closures eliminated the immediate market for approximately 8.3 million tons of timber annually, with about half sourced from local Georgia counties and the other half from Alabama and South Carolina (Dartnell, 2025).

2026 Outlook

Looking ahead, several demand- and supply-side factors are expected to shape Georgia’s timber markets in 2026.

Demand Factors

Key demand-side factors include a weakened housing market, reduced lumber mill utilization rates, pulp and paper mill closures and conversions, increased tariffs on Canadian lumber imports, labor shortages linked to immigration policies, and overall economic growth.

Weak Housing Market Demand

More than 70% of U.S. softwood lumber and structural panel consumption is tied to residential construction, particularly single-family homes and home improvement activities (Alderman, 2022). Although Federal Reserve interest-rate cuts in 2025 may reduce financing costs for housing construction—and indirectly ease mortgage rates—housing starts are expected to remain under pressure in 2026. Contributing factors include high home prices, elevated mortgage rates, rising construction costs, labor shortages because of changes in immigration policy, persistent inflation, a softening labor market, and stretched consumer finances.

According to the U.S. Census Bureau’s new residential construction report from September 2025, single-family housing starts fell 11.7% year over year to a seasonally adjusted annual rate of 890,000 units (U.S. Census Bureau, 2025b). Single-family building permits, a leading indicator, fell 11.5% to 856,000 units. Fannie Mae forecasts that single-family housing starts will decline by 2.5% in 2026. Together, these indicators suggest that housing starts in 2026 will likely remain below the long-term trend of approximately 1.2 million units. On a positive note, remodeling and repair activity is expected to continue its stable and slow growth in 2026 (Joint Center for Housing Studies, 2025).

Tariffs

Tariffs on Canadian softwood lumber imports have increased sharply since August 2024 (by 460%). Duties on most softwood lumber imports from Canada now total 45.16%, consisting of combined countervailing and antidumping duties of 35.16% and an additional 10% global tariff on imported softwood logs and lumber. While these higher tariffs may reduce Canadian imports and support U.S. domestic lumber production over the long term, they are likely to increase construction costs in the short run and further constrain housing starts.

Mill Capacity and Closures

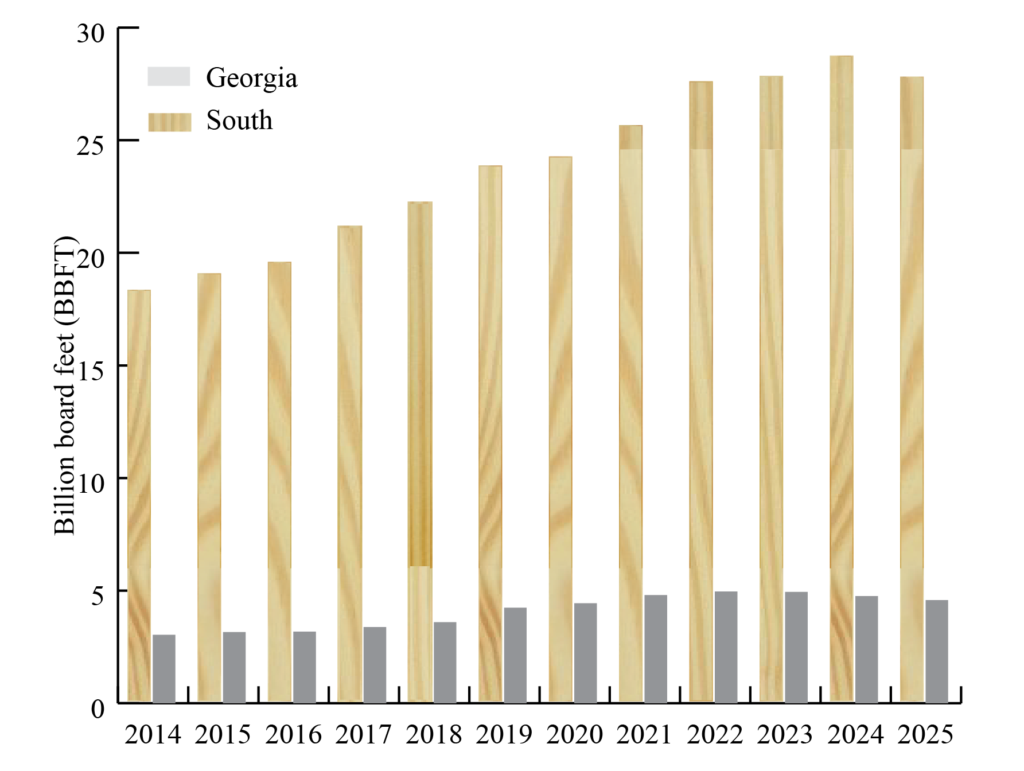

The U.S. South remains a preferred destination for softwood lumber and wood-using pulping investment because of abundant timber resources, a skilled workforce, and well-developed infrastructure. Southern softwood lumber mill capacity exceeded 27.7 billion board feet (bbf) in 2025, representing a 31% increase from 2017 (Figure 1), with an additional 1.62 bbf expected by 2027 (Forisk, n.d.).

From “North American mill capacity database,” by Forisk, n.d. (https://forisk.com/product/north-american-forest-industry-capacity-database/).

Similarly, Georgia’s softwood lumber mill capacity increased by 35% from 3.4 bbf in 2017 to 4.6 bbf in 2025. Canadian lumber companies account for a significant share of this expansion, driven by reduced log availability in Western Canada and ongoing U.S. trade restrictions. However, U.S. softwood lumber mill utilization rates declined from 81% in Q2 2021 to 78% in Q2 2025 (U.S. Census Bureau, 2025a). Insufficient orders and limited profitability were cited as the primary reasons for operating below full capacity.

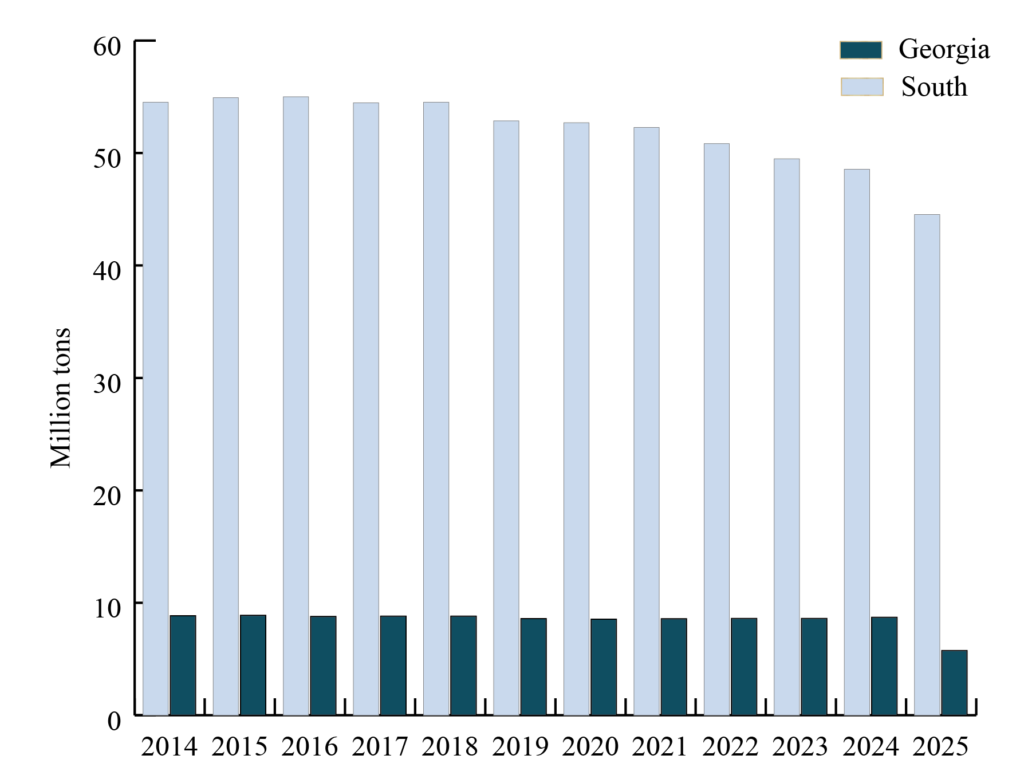

Meanwhile, southern wood-using pulping capacity declined to 44.72 million tons in 2025, reflecting product shifts in the paper and paperboard industries, increased use of recycled fiber in pulp production, and increased competition from foreign pulping capacity (Figure 2). Recent mill closures resulted in a loss of approximately 3 million tons of pulping capacity in Georgia. This downward trend is expected to continue to place pressure on pulpwood prices in Georgia, particularly in regions affected by Hurricane Helene and in areas experiencing recent paper mill closures.

From “North American mill capacity database,” by Forisk, n.d. (https://forisk.com/product/north-american-forest-industry-capacity-database/).

Supply Factors

Key supply-side considerations include tighter sawtimber inventory in areas impacted by Hurricane Helene, increased timber availability and greater supplies of sawmill residues resulting from mill closures in adjacent areas, and ongoing logging capacity constraints.

In Georgia, the average growth-to-removal ratio was 1.32 for pine stands and 2.35 for hardwoods, indicating an overall sufficient timber supply (Dartnell, 2025). However, these ratios vary greatly across local timber basins. In areas affected by Hurricane Helene that already had low growth-to-removal ratios prior to the disaster, a pine sawtimber shortage may emerge or become more acute.

Price Outlook

Taken together, these demand- and supply-side factors create uncertainty in Georgia’s timber markets. Overall, sawtimber prices in 2026 are expected to remain stable across most of the state, although some areas of South Georgia may experience modest sawtimber price increases because of local inventory shortages. Pulpwood prices are expected to continue their downward trend in 2026, but at a slower rate of decline.

References

Alderman, D. (2022). U.S. forest products annual market review and prospects, 2015–2021 (Report FPL-GTR-289). U.S. Department of Agriculture Forest Service. https://research.fs.usda.gov/treesearch/64129

Dartnell, D. (2025). Southeast Georgia timber markets & update on pulp and paper. Georgia Forestry Commission.

Fannie Mae. (2025, November 13). Housing forecast: November 2025. Retrieved December 14, 2025, from https://www.fanniemae.com/media/56451/display

Forisk. (n.d.). North American mill capacity database [Data set]. https://forisk.com/product/north-american-forest-industry-capacity-database/

GFC Forest Management Group. (2024, November 5). Hurricane Helene: Timber damage assessment. Georgia Forestry Commission. https://gatrees.org/wp-content/uploads/2024/11/Hurricane-Helene-Timber-Impact-Assessment-Georgia-2024.pdf

Joint Center for Housing Studies. (2025, October 16). Leading indicator of remodeling activity (LIRA). Harvard University. Retrieved December 14, 2025, from https://www.jchs.harvard.edu/research-areas/remodeling/lira

TimberMart-South. (2025). Quarterly market news. https://timbermart-south.com/industry-reports/quarterly-market-news/

U.S. Census Bureau. (2025a, June). 2025 quarterly survey of plant capacity utilization. https://www.census.gov/data/tables/2025/econ/qpc/qpc-quarterly-tables.html

U.S. Census Bureau. (2025b, September). New residential construction report. https://www.census.gov/construction/nrc/index.html

U.S. Forest Service. (2024). EVALIDator and FIADB-API [Computer software]. U.S. Department of Agriculture. https://research.fs.usda.gov/products/dataandtools/evalidator-and-fiadb-api